This page keeps an up to date list of all the questions that have been asked during the entire tender process and their respective answers. For transparency reasons, all the questions should be addressed via the form below and will be answered for the benefit of all potential suppliers. Please note that the answers provided are only meant as a guidance for interested parties, to allow for a common understanding by all potential suppliers. They are not legally binding in any way. The only binding documentation will be the Call for tender documentation.

IMPORTANT: Please note that some answers have been updated on 26/08/19. Questions for which the answer has been updated are clearly identified in the list below.

What is your question?

List of Questions & Answers

Pre-commercial procurement (PCP) process

What is R&D procurement?

It’s about R&D, not commercial development

R&D procurement concerns a purchase of R&D by a body governed by public law. In this context, R&D (Research and Development) concerns the phase before commercialization in a product development cycle. R&D can cover activities such as solution exploration and design, prototyping, up to the original development of a limited volume of first products or services in the form of a test series. “Original development of a first product or service may include limited production or supply in order to incorporate the results of field testing and to demonstrate that the product or service is suitable for production or supply in quantity to acceptable quality standards”. R&D does not include commercial development activities such as quantity production, supply to establish commercial viability or to recover R&D costs, integration, customization, incremental adaptations and improvements to existing products or processes.

Types of R&D procurement contracts

According to the terminology used in the public procurement Directives, a public procurer can choose between three types of procurement contracts depending on what is the objective of the procurement. The objective of public works contracts is to procure the execution of works, public supply contracts to procure the supply of products, and public service contracts to procure the provision of services. In this context, a ‘work’ means the outcome of building or civil engineering works taken as a whole which is sufficient of itself to fulfil an economic or technical function. ‘Public supply contracts’ cover the purchase, lease, rental or hire purchase, with or without option to buy, of products. ‘Public service contracts’ are public contracts other than public works or supply contracts having as their object the provision of services. A public contract having as its object both products and services within the meaning of Annex II of the Directives shall be considered to be a ‘public service contract’ if the value of the services in question exceeds that of the products covered by the contract. Also, for R&D, there is the possibility of a R&D works, R&D supplies or R&D services contract. This depends on whether the main objective of the contract for the procurer is to get R&D works performed (e.g. purchase of the construction of an R&D test site), R&D products to be supplied (e.g. purchase of the outcome of an R&D activity: e.g. acquisition of a prototype, hire of a beta/test version of a product) or an R&D service to be performed (e.g. purchase of a number of man-hours of researchers’ and/or developers’ services to perform R&D activities according to the procurer’s specifications).

PCP is a particular approach of procuring R&D services

PCP is one particular approach of procuring R&D “services” (it is not an R&D supply or works contract) in which risk benefit sharing at market conditions is applied. PCP enables public procurers to share the risks and benefits of undertaking new developments with the companies participating in the PCP in a way that does not involve State aid.

What makes PCP interesting for public procurers?

The following advantages can be considered from the public procurers’ side concerning the PCP process

- Ability to shape industry developments to better fit public needs

- Lead to better quality products at lower price

- Achieve desired degree of interoperability from the start

- Reduce supplier lock-in and recurring unforeseen customized development expenditures

- Opportunity to share development risks with suppliers – license free use for procurers

- Opportunity to share the R&D risk with other procurers through pooling of resources

- PCP can attract external financial investors for companies, which reduces for risk procurer to buy from innovative PCP companies in follow-up procurements

What are the potential benefits of PCP for industry?

The following advantages can be considered from the industry when engaging into a PCP process

(1) Opportunities to acquire international leadership in new markets

In pre-commercial procurement public authorities challenge industry to develop solutions for public sector problems that are so forward-looking and so technologically demanding that either no commercially stable solution exists yet on the market, or existing solutions exhibit shortcomings which require new R&D. By triggering the development of breakthrough solutions ahead of the rest of the world market, public authorities can through their role of demanding first buyer create opportunities for companies in Europe to take international leadership in new markets.

(2) Shorter time to market

The virtuous process of co-evolution of demand and supply enabled by pre-commercial procurement shortens the time-to-market for the suppliers that can better anticipate demand for new solutions and better align their product developments to fulfil concrete customer needs. Active involvement of interested public buyers from the early product development stages also enables public authorities to detect at an early stage potential policy and regulatory barriers that need to be removed in time to ensure short time to market for innovating public services.

(3) Wider market size, economies of scale

Assigning IPR ownership rights to companies participating in PCPs enables those companies to address wider markets beyond the procurer that initiated the development. Streamlining desired product specifications amongst suppliers and procurers at the stage when products are still under development empowers procurers to foster the necessary degree of standardization amongst suppliers to guarantee economies of scale and interoperability. Cooperation between procurers at the pre-commercial stage can act as a driving force to create the required critical mass on the demand side to reduce market fragmentation and increase economies of scale for suppliers in Europe. Through export focused commercialisation wide take-up and diffusion of the newly developed technologies can be achieved in different sectors, comprising private as well as public markets, locally and globally.

What is the selection approach regarding which company(ies) continue in each phase?

It is a competitive phased process. Suppliers work in parallel on their own solution. In other words, every supplier must answer all requirements successfully to proceed to the next phase. Details will be added after the finalization and publication of the Call of Tenders.

Can partners be added, or consortium be changed between phases?

Contractors that successfully completed Phase 1 and provided that their Phase 2 bid is selected (upon evaluation), will be awarded a Phase 2 contract. Contractors that successfully completed Phase 2 and provided that their Phase 3 bid is selected (upon evaluation), will be awarded a Phase 3 contract. It is a closed process, and no one can join in between phases, however, suppliers can add subcontracts in between phase according to the conditions set by the Call for Tenders. Details will be included in the published of the Call of Tenders.

How could a PCP process be initiated and how could the relevant and interested stakeholders be involved?

From the demand side, innovation procurement starts with an “unmet need” for innovative solutions, which is “a requirement or set of requirements that you (public procurers) have now or (preferably) one that you will have in the future, that current products, services or arrangements cannot meet, or can only do so at excessive cost or with unacceptable risk”.

From the supply side, the first step towards initiating a PCP process will be the publication of a Prior Information notice in the official journal of the European commission for notifying of the public procurer’s intention to conduct an open market consultation within the context of a PCP contract. This will have to incorporate a high-level description of the contract’s objective. In this phase all interested suppliers (industry representatives) will be invited to participate in the process of exchanging views and providing input on the basis of an Initial research and needs assessment identifying area(s) of focus and specific user needs, as well as the potential innovations which might meet them. This will provide the necessary input for refining / finalizing the necessary data prior to progressing to proceeding to the tendering process. Overall, this enables the procurer to cross-check before initiating the procurement, how realistic he has built his view on:

- the prior analysis and regulatory / standardization environment

- the desired minimum requirements for the innovative solutions

- the main assumptions in the business case

- the key contractual set-up and conditions for the procurement

Once Phase 3 is finished, will another open call be opened for the Commercial Phase?

The Commercial Phase is out of the scope of the SHUTTLE project. In case such an alternative will be decided, it should be taken into consideration by all potential suppliers that a similar tendering process will be required where public procurers will act as launch customers for such focused R&D services and close-to-market innovative goods after following the general steps mentioned below:

- The first step is to form a critical mass of purchasing power on the demand side (one large enough buyer or several smaller buyers in a buyer’s group). One that can incentivize industry to scale up the production to bring solutions to the market with the price and quality requirements for large scale deployment.

- For the second step, the procurer(s) make an early announcement of the innovation needs (with the required functionality/performance and possibly also price requirements). They express the intention to buy a critical mass of innovative products if industry can bring them to the market with the predefined price/quality requirements by a specific date. The procurers may wish to perform conformance testing of solutions of suppliers that have come forward with potential solutions by the target date. This is done to verify that there are indeed solutions that can meet their needs, before actually procuring the innovative solutions.

The third step is the actual public procurement of the innovative solutions through one of the existing public procurement procedures (e.g. open/negotiated procedure, competitive dialogue etc).

SHUTTLE PCP

What is the SHUTTLE project?

The aim of SHUTTLE (Scientific High-throughput and Unified Toolkit for Trace analysis by forensic Laboratories in Europe) is to support the development of a toolkit, which will facilitate the microtraces analysis collected in crime scenes. More information concerning the vision and concept of the project can be found here https://www.shuttle-pcp.eu/project-at-a-glance/vision-and-concept/

What is Joint Procurement? Who participates in the SHUTTLE Joint Procurement?

As per definition provided by EU, a Joint procurement combines the procurement actions of two or more contracting authorities. In this regard, the PCP Framework Agreement and Phase contracts will be awarded as one single joint procurement by the beneficiaries concerned. The group of procurers and the the buyer’s group have appointed a lead procurer to coordinate and lead the joint procurement.

The lead procurer will act as Contracting Authority, publish the PCP call for tender in the name and on behalf of the buyer’s group under the Greek applicable legal framework for public procurement coordinate the joint evaluation of offers. For other tasks related to the preparation of the call for tender, evaluation of offers, monitoring of the suppliers, validation/testing of solutions, evaluation of the results/impact of the call for tender, the effort to carry out these tasks can be shared between the members of the buyers group and the lead procurer (and where relevant by others such as end-users e.g. to test solutions, external experts e.g. to evaluate offers etc).

In SHUTTLE project the Group of Procurers is composed by the following partners:

- MINISTERE DE L’ INTERIEUR (MININT)

- NETHERLANDS FORENSIC INSTITUTE (NFI)

- KENTRO MELETON ASFALEIAS (KEMEA)

- LIETUVOS TEISMO EKSPERTIZES CENTRAS (LTEC)

- MINISTÉRIO DA JUSTIÇA (PJ)

- MINISTRY OF PUBLIC SECURITY- ISRAEL NATIONAL POLICE (MOPS-INP)

Lead Procurer is KENTRO MELETON ASFALEIAS (KEMEA).

How is the Procurement process organized? How long would the overall Procurement Process take?

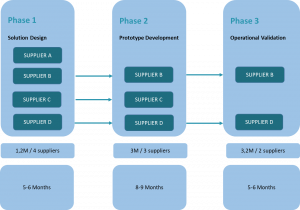

SHUTTLE approach adopts the basic concepts of the Pre-Commercial Procurement (PCP) as proposed by the European Commission, is outlined in the following figure also incorporating the approximate duration of each phase.

Will the SHUTTLE Consortium be purchasing the SHUTTLE toolkit after the SHUTTLE funding period? If so: a. how many microscopes and how much tape will the SHUTTLE Consortium be purchasing; b. over what time period will the above purchase be made?

The commercial exploitation of the R&D results is not into the scope of this project and the PCP. In any case, follow-up PPI procurements for a limited set of prototypes and/or test products developed during this PCP procurement (‘limited follow-up PPIs’) may be awarded by an new call for tender.

Follow-up PPI procurements for a commercial volume of the innovative solutions developed in this PCP procurement may be subject to a new call for tender.

(Answer updated on 26/08/19) - 1. In what form the tape lift will come from the user (respectively, in what form it shall be processed in the future machine? – an open tape lift; – a tape lift being folded up ( – would there be then a double layer of lifted particles?); – a tape sandwich consisting of the tape lift and an empty tape of precisely the same material; – a tape sandwich consisting of the tape lift and an empty tape of different material – please specify what material; – any other form, please specify. 2. The requirements state: “Further analysis after isolation from tape: FTIR, ICP-MS, DNA” – Shall particles destined to DNA analysis be isolated at first, before the particles for other analyses? – What criteria shall be applied in order to qualify a particle for subsequent FTIR and/ or ICP-MS analysis? And shall the toolkit software take this decision – or shall the user decide about that? – In what form the particles shall be put at disposition for FTIR: totally isolated particle or particle on a small tape area / inside a small tape sandwich area? Please specify the sample holder onto which the isolated particles have to be transferred. – In what form the particles shall be put at disposition for ICP-MS: totally isolated particle or particle on a small tape area / inside a small tape sandwich area? Please specify the sample holder onto which the isolated particles have to be transferred.

According to the EU Treaty principles, in particular the principles of transparency and equal treatment, the detailed specification of the tape lift or other lifting system as well as the SHUTTLE Toolkit, cannot be provided in this phase. More information will be made available on the 20th of September 2019 when the SHUTTLE PCP project will launch its call for tender to support the development of a Scientific High-throughput and Unified Toolkit for Trace analysis by forensic Laboratories in Europe.

Some general information can be provided mostly to clarify the general concept, as it was presented in the first Open Market Consultation in Paris as well as it is presented in the SHUTTLE webpage.

Specific requirements will be made available at the release of the tender and there will be given enough time for inquiries.

Regarding the tape lift or other lifting system, the supplier (e.g. a consortium of companies), has to develop a system that will be compatible with the SHUTTLE microscope as well as compatible for Optical Microscopy (Brightfield, Polarized / Fluorescent light microscopy and Microspectrophotometry). That means that traces can be examined with the aforementioned techniques while there are still inside the system. Furthermore, traces inside the tape lift or other lifting system shall be feasible to be isolated from the tape lift or other lifting system so as further examinations can be conducted like FTIR, ICPMS and DNA analysis. The user will decide which traces will be isolated for further examination with which techniques, following the laboratory’s Standard Operating Procedures.

In the Terms of Reference document will be described which traces will be isolated and their priority. The general idea is that the traces lifted with the tape lift or other lifting system will be well protected by the backing of the tape lift or other lifting system . The SHUTTLE Toolkit shall be able to automatically detect and identify initially the traces inside the tape lift or other lifting system without opening it. The user will then decide which traces will be isolated for further analysis. The main need here is that the trace has to be isolated from the tape or the other lifting system without being damaged, altered or contaminated so as examination of it with the aforementioned techniques following the laboratories SOP’s and instrumentation will not be obstructed. During isolation the remaining traces in the rest of the tape or the other lifting system have also to be protected from loss, damage or contamination, so as they can also be isolated for further examination in the future. The acceptable isolation options will be described more precisely in the ToR Document, which will be available online on the 20th September 2019.

Having all the above in mind, the supplier has to develop a suitable tape lift or other lifting system which will fulfill all the aforementioned needs.

Open Market Consultation

What is the Open Market Consultation?

The Open Market Consultation is an important step during the overall PCP preparation process, aiming at actively fostering the dialogue with the market in order to:

- validate the identified need and solution design with the supply side,

- explain clearly how confidentiality/IPR issues will be treated and

- build trust between potential buyers and providers by explaining the procurement need, the envisaged contracting setup to vendors and evaluating their feedback in order to fine-tune the tender specifications that will drive to prototypes and pre-operational solutions.

Request for Tenders

(Answer updated on 26/08/19) - When do you plan to launch the call for tender?

The SHUTTLE PCP project will launch its call for tender to support the development of a Scientific High-throughput and Unified Toolkit for Trace analysis by forensic Laboratories in Europe on the 20th of September 2019.

What is the deadline to answer the call for tender?

The SHUTTLE PCP Call for Tender has been launched on the 20th of September 2019 and is available here. Deadline for submission of proposal is the 20th November 2019.

(Answer updated on 26/08/19) - Which countries are eligible for funding?

Please note that this is not a call for proposals, but a call for tenders (there is thus no funding). In this call for tenders, procurers buy R&D services at market price.

Eligible to participate in the upcoming call for tenders, by submitting an offer, are:

-Natural persons residing in one of the following countries:

- EU and EEA (European Economic Area) member states.

- H2020 Associated Countries having signed a Bilateral Agreement with the EU on security procedures for exchanging and protecting classified information

-Legal entities established under the law of the following countries and having their central administration or principal place of business or registered office (seat) in one of the following countries:

- EU and EEA (European Economic Area) member states.

- H2020 Associated Countries having signed a Bilateral Agreement with the EU on security procedures for exchanging and protecting classified information

-Groups of economic operators of the above natural persons or legal entities.

Interested economic operators may take part in the tender process as soon as the SHUTTLE call for tender is announced on the project website and on TED (the online version of the ‘Supplement to the Official Journal’ of the EU, dedicated to European public procurement) where the contract notice will be published. The SHUTTLE PCP project will launch its call for tender to support the development of a Scientific High-throughput and Unified Toolkit for Trace analysis by forensic Laboratories in Europe on the 20th of September 2019.

Please check regularly our website https://www.shuttle-pcp.eu/ for more details on the project , the upcoming call as well as the Q&A section for potential clarifications https://www.shuttle-pcp.eu/pre-commercial-procurement/qa-section/.

Will a UK company be able to participate in the SHUTTLE PCP?

Natural persons residing in one of the following countries:

- EU and EEA (European Economic Area) member states.

- H2020 Associated Countries having signed a Bilateral Agreement with the EU on security procedures for exchanging and protecting classified information.

Legal entities established under the law of the following countries and having their central administration or principal place of business or registered office (seat) in one of the following countries:

- EU and EEA (European Economic Area) member states.

- H2020 Associated Countries having signed a Bilateral Agreement with the EU on security procedures for exchanging and protecting classified information.

Groups of economic operators of the above natural persons or legal entities, submitting a joint tender.

Based on the above, the eligibility of UK companies will depend on their actual status at the time of submission of tenders.

What are the IPR conditions in SHUTTLE?

SHUTTLE proposes an IPR (Intellectual Property Rights) approach, which is fully aligned with the fundamentals of PCP. SHUTTLE procures R&D services at market price, thus providing contractors with a transparent, competitive and reliable source of financing for the early stages of their research and development. The partners will set up the suitable mechanisms that will allow sharing risks and benefits between the Contracting Authority and the PCP contractors. The ownership of the IPRs generated by a supplier during the contract will be assigned to that supplier. Giving each contractor the ownership of the IPRs attached to the results it generates during the PCP means that they can widely exploit the newly developed solutions commercially. All the Consortium members will be assigned a worldwide free and non-exclusive license to use the R&D results for internal use. In return, the tendered price (market price) must contain a financial compensation for keeping the IPR ownership compared to the case where the IPRs would be transferred to the procurers. Moreover, the contractors can be requested to offer license to third parties under fair and reasonable conditions with respect to the rights of third parties that do not accrue to the contractors. It will be ensured that if the IPR rights are not exploited within 4 years after the finalization of the Framework Agreement, they will return through a call back provision to the Consortium members. Details will be included in the published Call of Tenders.

Where can I find partners to form a consortium?

Consortia can be formulated with companies at their own will. However, the SHUTTLE project in full compliance with the Horizon 2020 principles offers companies opportunities to form consortia via the below mentioned means:

- On the 30th and 31th of January 2019 during the Open Market Consultation event, a networking event was held, aiming to enhancing relationship between the participants.

- On the project website will be soon available a matchmaking tool, in order to help interested companies to formulate Consortia

Can I register to receive e-mail notification of the publication of the call for tender and associated documents (i.e. the exact SHUTTLE specifications etc)?

Of course you can register to the SHUTTLE newsletter where a dedicated anouncement for the Call for Tender release will be made.

(Answer updated on 26/08/19) - Is/are the precise date(s) of the release of the exact SHUTTLE toolkit specifications and the call for tenders known? If so, what is/are those date(s)? If not, when might this information become available?

The SHUTTLE PCP project will launch its call for tender to support the development of a Scientific High-throughput and Unified Toolkit for Trace analysis by forensic Laboratories in Europe on the 20th of September 2019.

(Answer updated on 26/08/19) - Are there any minimum requirements for the track record of any given company that is part of a consortium formed for the purpose of tendering for SHUTTLE funding? For example, is there a minimum age or revenue for each such company?

A set of eligibility, exclusion and selection criteria for the potential tenderers who would like to participate in the SHUTTLE PCP will be made publicly available through the CfT documentation, which will be launched by the 20th of September 2019.

(Answer updated on 26/08/19) - Consider a company that is part of a consortium tendering for SHUTTLE funds. In order to meet the needs of the SHUTTLE programme, this company needs access to technology that is owned by another party. That other party has agreed to grant that company access to the technology it needs and to do so by way of a licence. Does that licence have to exist before the tender can be made? Alternatively, would the SHUTTLE funding Consortium be content with a Memorandum of Understanding that states that the licence will be granted if the tender for SHUTTLE funding is successful?

The SHUTTLE Call for tender to support the development of a Scientific High-throughput and Unified Toolkit for Trace analysis by forensic Laboratories in Europe will be launched on the 20th of September 2019. Such being the case, no answer on the eligibility criteria can be given at this stage. If you still have doubts after the launch of the Call, you will have the opportunity to submit questions related to the tender within the time limits set in the Call and following the procedure explained therein.

(Answer updated on 26/08/19) - I would like to receive an update on the status of the upcoming tender and actions needed to be taken in order to get invited to bid.

Thank you for your email and interest in the SHUTTLE project. The SHUTTLE project is a H2020 project financed by the European Commission (EC) and it runs in the frame of Pre-commercial procurement (PCP). PCP is one particular approach of procuring R&D “services” (it is not an R&D supply or works contract) in which risk benefit sharing at market conditions is applied. PCP enables public procurers to share the risks and benefits of undertaking new developments with the companies participating in the PCP in a way that does not involve State aid. It is a competitive 3 phased process. Suppliers work in parallel on their own solution. In other words, every supplier must answer all requirements successfully to be eligible to submit a tender for the next phase. Interested suppliers may take part in the tender process. The SHUTTLE call for tender, including the toolkit specifications, will be announced on the 20th of September 2019.

Please check regularly our website https://www.shuttle-pcp.eu/ for more details on the project , the upcoming call as well as the Q&A section for potential clarifications https://www.shuttle-pcp.eu/pre-commercial-procurement/qa-section/. Another useful feature is the Matchmaking Tool https://www.shuttle-pcp.eu/matchmaking-form/ where other companies can contact you and create a future consortium.

Filling out the RFI questionnaire is not a prerequisite to participate in the tender but we strongly advise you to do so in order to us with insights of the current market status.

Are Canadian companies allowed to participate in the tender process?

SHUTTLE is a project funded by the EU Horizon 2020 Framework Program for Research and Innovation. Such being the case, the published call for tenders, aligned with H2020 rules, foresees the following:

Tenders may be submitted by legal entities established under the law of the following countries and having their central administration or principal place of business or registered office (seat) in one of the following countries:

- EU and EEA (European Economic Area) member states.

- H2020 Associated Countries having signed a Bilateral Agreement with the EU on security procedures for exchanging and protecting classified information.

Based on the above, Canadian companies can only participate as subcontractors, taking into account the following provisions of the published call: Tenders will be excluded if they do not meet the following requirements relating to the place of performance of the contract:

- at least 50% of the total value of activities covered by each specific contract for PCP phase 1 and 2 must be performed in the EU Member States or in H2020 associated countries. The principal R&D staff working on each specific contract must be located in the EU Member States or H2020 associated countries.

- at least 50% of the total value of activities covered by the framework agreement (i.e. the total value of the activities covered by phase 1 + the total value of the activities covered by phase 2 + the total value of the activities covered by phase 3) must be performed in the EU Member States or H2020 associated countries. The principal R&D staff working on the PCP must be located in the EU Member States or H2020 associated countries.

Would a company in the United States have to be a subcontrator in any tender?

SHUTTLE is a project funded by the EU Horizon 2020 Framework Program for Research and Innovation. Such being the case, the published call for tenders, aligned with H2020 rules, foresees the following:

Tenders may be submitted by legal entities established under the law of the following countries and having their central administration or principal place of business or registered office (seat) in one of the following countries:

- EU and EEA (European Economic Area) member states.

- H2020 Associated Countries having signed a Bilateral Agreement with the EU on security procedures for exchanging and protecting classified information.

Based on the above, USA companies can only participate as subcontractors, taking into account the following provisions of the published call: Tenders will be excluded if they do not meet the following requirements relating to the place of performance of the contract:

- at least 50% of the total value of activities covered by each specific contract for PCP phase 1 and 2 must be performed in the EU Member States or in H2020 associated countries. The principal R&D staff working on each specific contract must be located in the EU Member States or H2020 associated countries.

- at least 50% of the total value of activities covered by the framework agreement (i.e. the total value of the activities covered by phase 1 + the total value of the activities covered by phase 2 + the total value of the activities covered by phase 3) must be performed in the EU Member States or H2020 associated countries. The principal R&D staff working on the PCP must be located in the EU Member States or H2020 associated countries.

Finally, in case you are interested in participating in a Consortium, you may use the matchmaking tool.

When do you expect to publish the transcript or recordings of the webinar held on the 07th of October 2019? There was mention of a deadline at October 10 to ask questions, you would reply to no later than October 20. Can you confirm this? What types of questions does this deadline apply to? Only the topics addressed in the webinar (so PCP process; non-technical)? I can imagine that during the preparation of the proposal the coming weeks we will have additional questions regarding e.g. requirements.

The material of the Webinar will be available in the SHUTTLE website early next week.

The deadlines mentioned in your email are true and are included in the TD1 document. This deadline refers to all type of questions.

At this point, we would like to mention that the Tender documentation as published in the SHUTTLE website is the primary reference document that you should refer to regarding the tendering process and/or any technical issue. Please note that all information presented in any other mean is derived from this documentation.

Is it permitted under the SHUTTLE rules for a TENDERER to be awarded a SHUTTLE contract if: a. there are natural persons from non-eligible countries (i.e. those not listed on p43 of tender document TD1) that are: i. employed by the TENDERER; ii. seconded to the TENDER by their normal employer, even if that employer is neither established under law in an eligible country nor has its seat in one of those countries; iii. investors in the TENDERER; iv. board members of the TENDERER; v. suppliers of goods and/or services to the TENDERER? b. legal entities that neither are established under law in an eligible country nor have their seats in one of those countries: i. supply goods and/or services to the TENDERER; ii. licence intellectual property (patents etc) to the TENDERER? c. the TENDERER were to change between the phases of the SHUTTLE programme by: i. employing more, fewer or different people; ii. changing the number of people who are seconded to it or who those people are; iii. changing the number of its investors, the amount that each investor invests or who those investors are; iv. changing the number of its shareholders or who those shareholders are; v. changing the number of its board members or who those board members are; vi. changing the number of legal entities or natural persons that supply goods and/or services to the TENDERER, irrespective of where those persons or entities are from; vii. changing the number of subcontractors or who those subcontractors are; viii. altering its management structures and/or internal procedures? d. the TENDERER were a brand new legal entity established within one of the eligible countries as defined on p43 of tender document TD1 for the purpose of submitting a tender under the SHUTTLE programme as any one of: i. a single entity; ii. part of a joint tender; iii. a subcontractor?

In the SHUTLLE tender documentation there is no provision/restriction on the issues referred under points 1a, 1b, 1c, 1d. However, provisions on the exclusion, selection and compliance criteria should be taken into account, such as (indicatively): 1. in the offer should be included, inter alia, a list of staff working on the specific contract (including for subcontractors), indicating clearly their role in performing the contract (i.e. whether they are principal R&D staff or not) and the location (country) where they will carry out their tasks under the contract, 2. The tenderer should demonstrate the ability to perform R&D up to original development of the first products or services and to commercially exploit the results of the PCP, including intangible results in particular IPRs and the expertise and working experience required to undertake an innovative R&D project that entails relevant technology.

With reference to the selection criteria set out in Section 3.3 p49-51 of tender document TD1, what financial and economic capacity must each TENDERER and each CONSORTIUM be able to demonstrate at the start of each phase of the SHUTTLE programme. For example, will each TENDERER and each CONSORTIUM need to show that it has the necessary financial capacity to deliver on all phases of the programme before it can apply for phase 1?

As stated in the TD1, tenderers should provide a description of the availability of financial and organisational structures for management, exploitation and transfer of IPRs and for generating revenue by marketing commercial applications of the results, meaning for all PCP phases. For what is needed to be demonstrated (and how) , see also Annex A-TD4, section 2, which is requested to be submitted by each member of the Consortium.

On p53 of tender document TD1, it is stated that “…the total value of products offered in phase 1 respectively phase 2 must be less than 50 % of the value of the phase 1 respectively phase 2 contract and the total value of products offered in phase 3 must be so that the total value of products offered in all phases (1,2 and 3) is less than 50% of the total value of the PCP framework agreement.”. I take this to mean that for each CONSORTIUM, the total value of phases 1, 2 and 3 must be less than half of 5,967,741.94 Euros. Is this correct? Also, I do not understand what this quoted passage is saying about the maximum permitted value of each of phases 1 and 2 for each CONSORTIUM. Please will you clarify this? For example, does it mean that the value of phase 1 must be less than 50% of the value of phase 2 for each CONSORTIUM?

No. The total value of products offered, in relation to services, must be less than 50% of the value of the phase 1 respectively phase 2 contract and the total value of products offered in phase 3 must be so that the total value of products offered in all phases (1,2 and 3) is less than 50% of the total value of the PCP framework agreement.

As for the maximum budget foreseen per contractor, per Phase, see the table below (point 2.8, page 32 of TD1):

| SHUTTLE PCP Phases |

Minimum Number of contractors expected to be selected |

Maximum budget per contractor | Total cost per phase |

| PCP Phase 1 (Solution Design) | 4 | 241,935.48€ | 967,741.94€ |

| PCP Phase 2 (Prototype Development) | 3 | 806,451.61€ | 2,419,354.84€ |

| PCP Phase 3 (Operational validation) | 2 | 1,290,322.58€ | 2.580.645,16€ |

In the tender documents a project management plan according to popular methodologies (e.g. PMI, PRINCE 2) is stated as well as risk management plan and quality assurance. Is it necessary to fully elaborate these documents now for tendering on November 20, or is it sufficient to present a rough outline that will be supplemented later in phase 1 with the required details according to PRINCE 2?

The technical offer to be submitted (see also TD5), should contain, inter alia:

[…]

- a project management plan that outlines the execution and monitoring approach, including a Gantt chart.

[…]

- a risk assessment and risk mitigation strategy

The description provided in the technical offer will be, therefore, assessed and evaluated according to the weighted award criteria, which for the pending tender are those of Phase 1 (criteria for awarding Phase 1 contract).

I am looking for some additional information in relation to the SHUTTLE project, its scope and intended value so that I can evaluate its potential significance for our organisation. Please could you provide me with some additional literature?

SHUTTLE is a Pre-commercial procurement EU project.

Pre-commercial procurement is a special form of public procurement which is adapted to research and innovation: public authorities in a step-by-step process select organisations which offer to carry out research and innovation activities. After a first early prototyping stage, a reduced group of finalists is retained to deliver the final prototypes.

SHUTTLE aims to solve two major issues in forensic microtrace evidence investigation. First, current analyses are subjective and require a high level of expertise and training of examiners. SHUTTLE will render analyses more objective and scientific. Second, microtrace evidence analyses are time consuming and hence expensive. This limits the number of cases in which analyses can be carried out.

SHUTTLE will automate a significant part of forensic microtrace evidence examinations. The core of the SHUTTLE toolkit will consist of an automated microscope that will acquire high quality images of recovered microtraces. The acquired images will be processed automatically and an overview of available microtraces will be reported. In first instance, SHUTTLE focuses on Blood, Fibres/Hair, Glass, Saliva, Sand/soil, Skin cells. Algorithms to classify these microtraces will be developed. Additional algorithms can be developed by users or third parties. The additional algorithms can be added as plug-ins for more accurate classification of the aforementioned microtraces or for extension of the range of microtraces that can be classified. The data will be stored in a computer database, thereby facilitating future data analysis, such as provenancing of microtraces and forensic comparisons.

Introduction of the SHUTTLE toolkit will have several advantages for forensic laboratories and the connected entities. The automation will allow a more efficient workflow, while the obtained results will become more objective. The unbiased nature of the analyses and the available database will enable national or even international exchange of data.

Wide implementation of the SHUTTLE toolkit will harmonise the procedures for microtrace evidence examination in laboratories throughout Europe and hence facilitate better international collaboration and exchange of data. Laboratories may decide in the future to use data in a shared database for their data searches, taking into consideration and respecting the relevant legal and ethical requirements. In a similar way, data acquired by several laboratories can be used to calculate background populations and the calculation of the evidential value of the results. They may ask for help from international colleagues by just indicating a reference key under which data is stored in the joint database.

The standardisation of working procedures will form an excellent educational tool, as police officers and forensic experts can improve their knowledge by studying samples in the database. The SHUTTLE toolkit will also form a major incentive for Research and Development studies, e.g. by enabling discrimination and background studies.

Please find more details in SHUTTLE website : https://www.shuttle-pcp.eu.

In modern content systems, functions are processed in subsystems. The database is a (sub) component and manages meta and index data, relations and references. Objects (pictures, video, documents) are stored separately. Functions such as full text enable comprehensive searches. Are we right in the assumption that the target system (data storage and management system) is called here database and the required functionalities such as user management, etc. must be ensured by the target system and not by the SQL database?

The operational details of the database are left to be decided by the tenderer. The database as described in the technical offer, will be evaluated to the degree that the requirements are satisfied and not on the specific technical choices that will be made by the tenderer.

For the purposes of question above, does FSPEC6.29 and the requirement for open source apply to the entire target system or just the parts that perform rule-based processing? Software and know-how for data storage and processing represent a substantial business value. User-friendly systems are based on years of experience and constant technological development. Is it allowed for the target system to mix open source and proprietary systems? All interfaces are documented or standardized.

In FSPEC6.29 indicates, there is a minimum requirement for a database that is “based on open source software or shall be at least accessible by standard software, such as MATLAB, Python and R” so that exchange and collaboration is guaranteed.

Do you have already a detailed agenda for the half day workshop in Heraklion?

Below is the agenda for the event:

SHUTTLE First Public Workshop, 30th October 2019 (Half day, 14:00-17:00)

———————————–

SHUTTLE introduction

————————————–

Discussion towards Industrials

Call for tender/PCP process

Toolkit requirements

————————————–

Discussion towards End-users

Future applications

Path to Standardization

TD1 page 59 award criteria ph2 and 3. Is it expected that the criteria for Phase 2 and 3 are completed already until 20th of November or are they part of the following phases?

The award criteria for Phases 2 and 3 should be fulfilled with the offers submitted within the call off for Phase 2 and call off for Phase 3 respectively.

TD1 page 53 award criteria on/off definition of R&D services Definition of products: What is the meaning of the term products? Is this the amount of hardware that is necessary to configure the toolkit?

The definition of services means that the value of the total amount of products covered by the contract must be less than 50 % of the total value of the PCP framework agreement. Consequently, any product, such as hardware etc, to be used or developed should be less than 50%.

In any case, you have to keep in mind that at least 50% of the total value of what will be created/ developed has to be R&D services.

Could you say a few words about the participation of the academic labs because they are some points to which we cannot answer (business plan, commercial exploitation)?

You have to keep in mind that eligible to submit a tender is every legal entity, so the universities are also eligible to submit a tender. However, we have also set a number of eligibility criteria, selection criteria etc. Consequently, what is important is not the legal status of the tenderer but whether it complies with the eligibility and selection criteria.

It is important to note that it depends on whether the organization can really respond to all the requirements of our call. If not, you can always submit a tender in a Consortium in collaboration with other legal entities in order to cover all the requirements.

Can you please inform us, in case of a formation of a consortium, do we need to have a large-scale company to insure the commercialization criteria? And if yes, do we need the presence of that company from phase 1 or we can declare its potential presence by submitting a letter of expression of interest?

First of all, you cannot change the Consortium that will submit a tender and this Consortium in case it becomes a contractor and it is awarded a framework contract agreement, this Consortium must continue in all phases. So, no changes are accepted, unless in fully justified exceptional cases.

In terms of big companies, this depends on how well you can justify your commercialization plan. So, we do not have specific requirements for the size of the company or the group of organizations that will submit a tender, but what is requested is a good justification on the commercial exploitation of the results.

Can you elaborate on the potential savings of 140K per year per lab?

This is derived from a project deliverable whose dissemination level is confidential so no more information can be given regarding the calculation.

Concerning the SHUTTLE tender document TD3: that document lists background IPR offered to the SHUTTLE project by members of the Buyers’ Group. Are you able to send me any further details of the background IPR that is referred to in that document and which is available to those planning to bid for a SHUTTLE contract? I am particularly interested in the IPR that is offered by the Netherlands Forensic Institute (NFI).

Annex H (document TD3) defines pre-existing rights held by the procurers, according to H2020 rules. At this stage it is not possible to provide you with more information on background IPRs offered by the Buyers Group; further details will be communicated to the contractors who decide to use the background, under the conditions set by the Framework Agreement.

It is interesting to see that due to high interest the deadline both the deadline to ask questions and to get answers are postponed. Since answers could impact the actual tender, are you open to extend the submission deadline also?

The deadline for questions-and inevitably the deadline for answering the questions-have been extended in order to make sure that all questions have been answered and all issues have been clarified, permitting, thus, all Tenderers to submit offers that will correspond to the Procurement requirements. Currently, SHUTTLE buyers group has not made any decision to extend the deadline for receipt of tenders.

Items (e.g. tape) that are or we believe could be commercially off the shelf available, can be excluded from the technical part of the offer? Might affect financial part, but we do not necessarily have to develop what either is being or has been developed already?

What is expected to be developed is a solution that covers all the specifications as described in the Call for Tenders, i.e. a cost-effective, open machine integrating a rich toolkit for automated trace evidence analysis. Furthermore, Tenderers should present a financial offer which is taking into consideration all criteria set by the Call for the evaluation of the tenders, including the exclusion criterion that the whole solution proposed is not available in the market.

Some parts of the requested method may require more development than other parts. If parts of the solutions proposed by possible suppliers can be bought off the shelf, they still need to be included in the offer, even if no development is needed. However, the solution proposed should cover the on/off award criterion (compliance with the definition of R&D services) for at least 50% R&D activities. The tenderer may choose whether the partner supplying the already developed part is considered a sub-contractor or as a part of the consortium.

What tape (brand / model) is typically being used now for which is being stated that it doesn’t allow high magnification microscopy.

Tapes are usually used from laboratories in Europe for trace recovery (tape lifting). Typically, they use either commercial products of tapes available in the market or special tapes for forensic application. For high magnification microscopy the typical procedure that these laboratories follow, is the isolation of the trace(s) from the tape lift, then the examination of the isolated trace(s) using a conventional optical microscope after they are mounted properly in a glass slide. A development of a new tape lift compatible for a) tape lifting of various traces as described in the Call for Tenders and b) SHUTTLE toolkit will be required.

The financial offer for phase 1 is fixed and binding. For phases 2 and 3, unit prices are binding. Does this apply to all units or only personnel and material that is foreseen. Material selection and cost could typically be a result of phase 1.

As stated in TD1 and TD6, an offer should provide unit prices for items that are expected to be needed for Phases 2 and 3.

The offer should be valid for 6 months. Are delivery dates relative to the offer acceptance date? In theory the offer is accepted after the start date as set for now.

The offer for the current Tender should be valid for 6 months from the 20/11/2019 (deadline for submitting offers). For the next Phases (2 and 3) new offers will be submitted, eventually with a new validity period, according to the same terms and provisions to be set in the Call offs for Phase 2 and 3.

Can you elaborate on the calculations made leading to the conclusion that a yearly saving of 140K can be made? E.g. o Is that solely based on the reduced human effort? o Based on how many cycles a year? How many FTE in average? o Based on what investment or savings on other investments or operational expenses.

The calculation is based on estimates including the cost of both instrumentation and human efforts. Since the question is not related to the tender and the information is derived from a SHUTTLE project deliverable whose dissemination level is confidential, no more information can be given regarding the calculation.

Specifications of a system can be interpreted by readers differently. How do you plan to deal with ambiguity and Change Requests during development?

Specifications set will remain unchanged during the whole PCP process. What we expect is to receive offers which present a solution covering all specifications set in the Call, respecting all requirements and criteria and reaching the threshold of TRL 8.

Does the company or consortium of companies behind any bid have to include a producer of tapes that not only is compatible with the system under development but also other (optical) microscopes

Please refer to TD2 for more details. Specs FSPEC2.1, FSPEC2.3, FSPEC2.4 and FSPEC2.2 may provide clarifications. In case as specific question arise after reading this document, please come back to us until 31st of October 2019.

For tapes that need further development will there be a separate PCP as hinted at in the Q&A section? It seems that tapes need to be compatible with current manual workflows.

As stated in the Call, PPI procurements for a limited set of prototypes and/or test products developed during this PCP procurement (‘limited follow-up PPIs’) may be awarded. For this to happen, a PPI call may be launched. For more information see https://ec.europa.eu/digital-single-market/en/news/frequently-asked-questions-about-pcp-and-ppi

TD-1; p13; Is it possible to get some examples of these acquired images (i.e. full scans of a microscope slide)?

The acquired images mentioned in p13 of TD1 are a result of the system to be developed. They are not currently available in end-users’ labs. So examples requested cannot be provided by the procurers at this stage.

TD-1; p13; Is it correct that they only want to store the images (optical, spectral etc) that were taken of a trace, not the complete A4-sized area? And first store these in some local storage, and only after validation by an operator will these be transferred to ‘the database’?

Please refer to TD2 for more details. What is not described in this document, is left to the tenderer’s choice.

In case as specific question arise after reading this document, please come back to us until 31st of October 2019.

TD-1; p14; What is meant exactly by High Magnification Microscopy? Can we get example images of what they consider a suitable resolution image of a certain trace?

For tape specifications for SHUTTLE Toolkit please refer to TD2. Tape should be feasible to be viewed using a conventional optical microscope with which, an unobstructed observation of traces as well as their morphological features shall be feasible.

FSPEC 3.1 Are these “M” images intended to be focal stacks? If so, how many layers? Covering how much Z-distance?

In the FSPEC 3.1 10 μm dimension refers to x*y plane not to z. The option of focal stacks is not described here but is not forbidden. Keep in mind the FSPEC3.25 has also to be fulfilled.

This implies e.g. that a focal stack may be needed if the support of the tape or the microscope stage is uneven. It is up the suppliers to decide whether a focal stack is needed to comply with F3.25.

What security/privacy etc standards/certifications need to be complied to?

All specifications regarding security/privacy set are included in TD2.

Does the user need to be presented a true optical microscope image to assist her decision making process for further processing or may the user also be presented a reconstructed image?

According to FSPEC3.21 the use of images with a reconstructed colour is allowed. The use of reconstructed images is not prescribed in TD2. Every proposed solution is acceptable if it is compliant with the set specifications.

Can the current process be demonstrated in a local forensic lab or will it only be discussed in the workshop in Crete?

At this stage, no demonstration in forensic labs has been planned.

In order to be able to distinguish between different types of traces such as blood, glass, saliva, sand/soil and skin cells ground truth (representative examples of these traces) is needed. Is such ground truth available?

No representative example of traces will be given at this stage. In the call-off of Phases 2 and 3, the description of tests that will be performed, will be announced. In these tests the sample preparation procedure will be described.

The computation of optic properties of a trace is mentioned for example in (FSPEC4.7). What optic properties should the algorithms be able to compute for a trace?

Please see TD2 FSPEC 3.15 where the measurement of the birefringence of fibers is referred. The average transmission and reflectance spectrum has to be computed for the effective measurement spot of 50μm for bigger traces referred at FSPEC 4.7 as well as for smaller traces.

The algorithms are not specified, as there might be different calculations that provide useable metrics. For most analyses, simple calculations are expected, e.g. %Reflectance, or %Transmittance. Please note that automatic calibration is required (NFSPEC1.1). This implies (but is not restricted to ) correction for the intensity of the lightsource.

In FSPEC6.24 it is stated “Data extracted from the database shall be processed to yield an image of the tape system or the lifting system where traces that are similar or identical to a specified trace are highlighted, so that the original distribution of these traces can be assessed”. From this I understand that the distribution of traces is assessed by visually inspection?

Yes. It should be added that FSPEC6.24 is not the only specification regarding data representation. Specs FSPEC6.19-FSPEC6.25 all specify an manner in which acquired data can be presented to the user. The visual overlay is one of these representations.

In FSPEC6.21 a measure for rarity of a target trace is mentioned. What is the difference with respect to the count of similar or identical traces as mentioned in FSPEC6.23?

In FSPEC6.23 the number of similar traces in the case under examination are counted (eg. How many times do we see the same trace in this case). On the contrary in FSPEC 6.21 the rarity of the trace is computed by taking into account the number of similar traces compared to the questioned trace, not in the same case under examination but in the hole database records (or a part of the database using prespecified criteria). In other words, it can be described as the frequency of this trace in other cases that were examined in the past and their results have been recorded to the database.

In FSPEC7.2 it is stated: “The system shall be fast. The system shall be able to process (modes as indicated in FSPEC3.2) a A4 sized tape system or any other lifting system in less than 5 hours without user intervention.”. Does this include only the time required to retrieve the raw data or also automatically perform analysis?

The time for analysis is included.

In NFSPEC2.3 and NFSPEC6.3, the handling of traces that are recovered using other media than the SHUTTLE tape or any other lifting system are mentioned. Is it also expected that all algorithms (such as localization of traces and classification of these traces) generalize to these other media?

Yes all algorithms generalise to these other media, especially localization and classification of traces which is the main goal for SHUTTLE Toolkit. The only limitation is the properties of the alternative media that will be used (eg. If the alternative media that will be used is not transparent in UV region, than the transmission in UV region is not expected to be recorded and computed.)

Guaranteeing very high accuracy is very difficult in a completely automated solution. An alternative would be a semi-automated pipeline. Combining efficient algorithms with (limited) human effort one might be able to reduce human effort in a cost effective manner whilst still guaranteeing very high accuracy. An example could be to ask the user to verify a subsample of trace classifications. Could this be part of the solution? or is a completely automated approach required?

FSPEC3.17 clearly states “The instrument shall be driven by a computer and software and does not require user intervention after the acquisition is started.” Additionally from the combination of FSPEC3.17 as well as FSPEC7.2, FSPEC7.3, FSPEC 6.19, FSPEC 6.30 and FSPEC3.19, it is expected that all the procedures will be performed automatically, including the first classification of traces. Then after the completion of the tape system scanning and the automated analysis, the user will be able to review the results (or part of them) and/or revisit the traces for validation or for correction/reclassification.

Nevertheless, if a classification algorithm is made self learning, it is of course possible to ask the user to assist in classification in order to improve future classification. However, this should be considered an extra feature, not a replacement of the current specifications that require full automation.

Can you please clarify what kind of “certificates” and “forms of documentary evidence” (as referred to in tender document TD4, attached) are required for supporting all kinds of criteria (exclusion, selection, etc) where needed as extra evidence apart from self-declaration?

For the evidence required (if any, depending on the criterion) at this stage, please see sections 3.2., 3.3. and 3.4 of TD1. In any case, please note that should there be any doubt as to any of these criteria, tenderers may be requested to provide additional information.

For the staff who will be working for any given consortium in the event of a successful bid, do you need extra documents (e.g. personnel contracts) or are their CVs enough?

As stated in TD 1, in order to demonstrate the expertise and working experience required to undertake an innovative R&D project, tenderers should provide a number of CVs of key personnel and competences, which they consider necessary to complete the project. In any case, please note that should there be any doubt, tenderers may be requested to provide additional information.

This question concerns the type of evidence needed to demonstrate the “ability to perform R&D” that is referred to on page 5 of tender document TD4 (attached). Please consider a consortium of companies that have members of staff who have relevant experience gained during the delivery of previous projects that they engaged in whilst working for employers that are not part of that consortium. Can this experience be cited as evidence that the consortium has the “ability to perform the R&D” required for the SHUTTLE project?

This question is related to a decision/assessment of the Contracting Board, on the selection criteria set by the Shuttle tender.

Therefore, no reply/clarification can be provided at this stage, the decision/assessment being an exclusive task of the above mentioned Board, after the submission of the tenders.

On page 6 of TD4 (attached) it states that each consortium bidding for a SHUTTLE contract needs to “Confirm the appropriate level of insurance cover if it is to be successful in winning the contract.” Please will you provide details of the types of risk that must be insured against (e.g. damage to buildings and their contents, public liabilities, professional liabilities, employer liabilities) and what level of cover (in Euros) is considered to be appropriate?

The risks and the level of insurance cover should be in respect of all risks which may be incurred by the Contractor, arising out of the Contractor’s performance of the Framework Agreement.

On page 6 of TD4 (attached) bidders are asked to "-Confirm the Business Continuity / Disaster Recovery / Risk Management plan that ensures that the described services are delivered in the event of a disruption affecting your business and ensures continuity of supply / service from your critical suppliers.". Are you able to provide guidance as to what would constitute an appropriate “Business Continuity / Disaster Recovery / Risk Management plan”?

This question is related to a decision/assessment of the Contracting Board, on the selection criteria set by the Shuttle tender.

Therefore, no reply/clarification can be provided at this stage, the decision/assessment of what constitutes an appropriate “Business Continuity/Disaster Recovery/Risk Management Plan” being an exclusive task of the above mentioned Board, after the submission of the tenders.

In FSPEC3.1 on page 12 of TD2 (attached), reference is made to “M images”. Please will you confirm what is meant by “M” in this context? For example, is it simply a natural number variable representing the number of images taken?

“M images” refers to microscope digital RGB (Red Green Blue) images, in transmitted light illumination, of the area that has been analysed.

As given on page 10 of TD2 (attached), FSPEC1.8 states that “The tape system or any other lifting system shall have a shelf life of at least three years.” and FSPEC1.11 is that “It shall be possible to examine the tape system or any other lifting system after long term storage (10 years) in dark and dry environment.” To test literal compliance with these specifications would require timespans that are greater than the combined length of the phases 2 and 3 of the SHUTTLE PCP. Therefore, presumably, the SHUTTLE programme expects tenderers to develop testing regimes that will include accelerated aging tests aimed at the simulation of the storage of the lifting system for these periods of time. Is this presumption correct? If so, please will you provide guidance on what form those accelerated aging tests should take?

It is up to each manufacturer to provide evidence (for example set up each own ageing tests, provide a test report from a conformity assessment body or a certificate issued by such a body) for the compliance of the tape system with these specifications.

«Description of the availability of financial and organisational structures for management, exploitation and transfer of IPRs and for generating revenue by marketing commercial applications of the results. » What it is needed to demonstrate the financial capacity ?

As stated in Section 3.3 of the TD1, the ability to commercially exploit the results of the PCP, including intangible results in particular IPRs, should be demonstrated by the financial and organisational structures to:

- manage, exploit and transfer or sell the results of the PCP (including tangible and intangible results, such as new product designs and IPRs)

- generate revenue by marketing commercial applications of the results (directly or through subcontractors or licensees).

Therefore, it is up to the tenderers to adequately describe the financial capacity in the above context.

Finance

What is the overall subcontracting budget?

The total amount dedicated for all phases of the procurement process is 5.9 million excluding VAT.

(Answer updated on 26/08/19) - What is the percentage of the costs incurred during the development of the SHUTTLE toolkit by a successful funding recipient that will be covered by the SHUTTLE funds?

The PCP is a procurement and not a grant (thus no funding will be provided). Payments will be made to the contractors based on the invoices issued, in accordance with their financial offer (a detailed financial section will be included in the CfT, which will be published on the 20th September 2019). In any case, the maximum budget per PCP phase and the maximum budget per bidder (including VAT and other taxes and duties that may be applicable to the supplier) will be indicated in the CfT which will be launched on 20th of September 2019.

(Answer updated on 26/08/19) - On what dates during the SHUTTLE programme will the funding be released and what would a successful funding recipient need to demonstrate in order to draw down that money?

Payments corresponding to each PCP phase will be subject to the satisfactory completion of the deliverables and milestones for that phase.Interim payments and payments of the balance is likely to be foreseen. Detailed provisions will be included in the CfT, which will be launched by 20 September 2019.

Piloting

(Answer updated on 26/08/19) - How will the solutions be validated in Phase 3?

The participating contractors successfully completing Phase 2 and continuing in Phase 3 will develop the final version of the Toolkit. In Phase 3 will be conducted experimentation of the prototypes in real environment of the Forensic Labs using relevant operational benchmark cases and samples. It will be validated if the Toolkit results to be an effective Solution for the End-user from an operational perspective. In this regard, operational scenarios will be developed with specific areas and measurements of testing. Details will be added and included in the published Call of Tenders; the publication will take place on the 20th of September 2019.